Category Archives: IRS

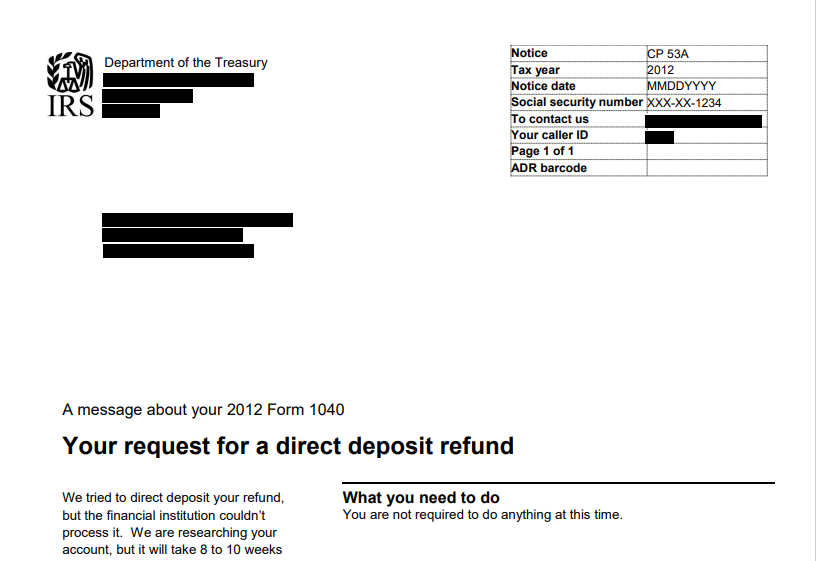

What is a CP53A IRS Letter?

Question: Why did I get a cp53a from the IRS if I didn't file taxes for 2020 it came in my child name also her father filed not me?” The IRS CP53A Letter means IRS tried to deposit your tax refund into your bank account but your bank cannot...

Read More ›

What is Republic Bank Trs RT Fed

According to Republic Bank, a Republic Bank Refund Transfer (RT) allows customers to pay for their tax preparation fees with their refund check from the IRS. A Refund Transfer Fee will be charged in addition to the tax preparation fees upon...

Read More ›

States Giving Out More Stimulus Money

We can help you get your stimulus money. Call us (213) 418-9600 or (866)542-9551 Below are states that are giving out stimulus money. California California has authorized payments of $600 to qualifying taxpayers in the state who make under...

Read More ›

Families now Receiving Child Tax Credit Payments

IR-2021-169, Aug. 13, 2021 WASHINGTON — The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit (CTC) payment for the month of August as direct...

Read More ›

Get Your Stimulus Money

Third Round of Economic Impact Payments Status Available IRS is issuing the third payments in phases. Find when and how we sent your third Economic Impact Payment with the Get My Payment application. Get My Payment updates once a day, usually...

Read More ›